On December 19, 2023, the 2022-2023 China Textile and Clothing Enterprise ESG Performance Evaluation results were released at the 2023 China Fashion Industry ESG Governance Summit.

The ESG performance evaluation of this industry was jointly conducted by the Office for Social Responsibility of CNTAC, Far East Credit Management Co., Ltd., and the Xuri School of Business Administration at Donghua University. By scientifically and effectively evaluating the ESG performance of Chinese textile and clothing enterprises, we aim to help them identify challenges and risks in their management and practice, provide strong support for achieving sustainable development goals, enhance brand image, and enhance competitiveness.

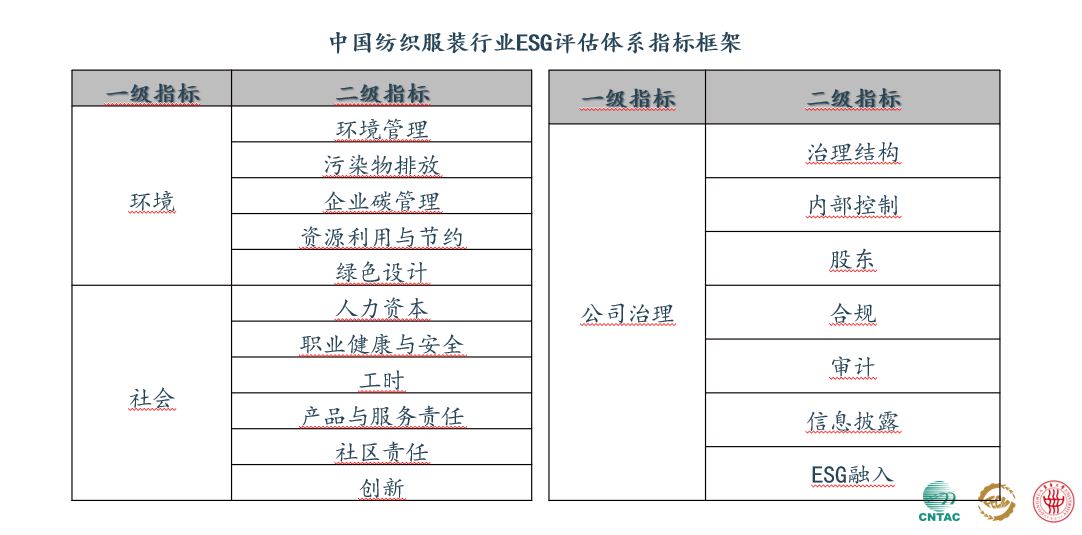

The ESG evaluation system for the Chinese textile and clothing industry has constructed a three-level indicator framework, which includes 18 secondary indicators and 119 tertiary indicators in addition to the three primary indicators of environment, society, and corporate governance. The evaluation targets all textile and clothing sector enterprises listed on both A-share and Hong Kong stock markets (excluding delisted enterprises), totaling 116.

To ensure the objectivity and comparability of ESG assessment in the Chinese textile and clothing industry, the indicator assignment in this methodology follows the principles of quantification and objectivity. Based on extensive theoretical analysis in the early stage, combined with the obtained data’s characteristics, each indicator’s weights are set according to the principles of balance and applicability. The weighting is calculated from bottom to top to obtain the sub-scores of the primary and secondary indicators, and finally, the comprehensive ESG evaluation score is calculated. The higher the score, the better the performance of the participating entity.

There are 2 rated AAA, 9 rated AA, 21 rated A, 29 rated BBB, 43 rated BB, 12 rated B, and 0 rated C; Enterprises show a significant negative distribution, with 57% of them scoring lower than the industry average. Most enterprises are rated at the BB level, accounting for 37.07%.

From the statistical results of the scores of environmental information, social information, and corporate governance disclosed by the listed companies in this round, we can see that the majority of companies have a conservative attitude towards disclosing environmental information. Social information disclosure mainly depends on the independent willingness of enterprises; the vast majority of enterprises can comply with exchange requirements for corporate governance information disclosure.

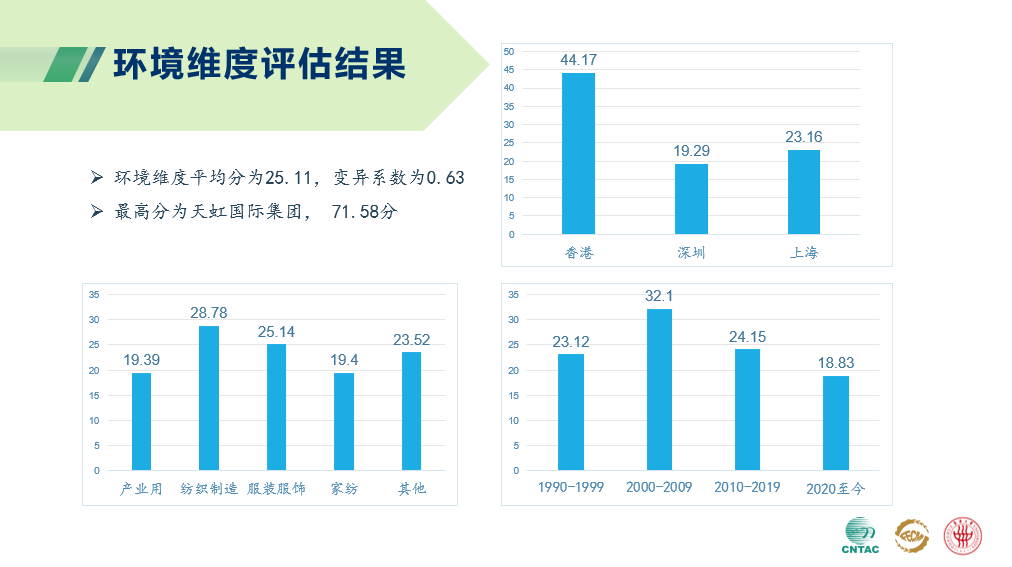

In the environmental rating, only one enterprise has reached the AAA level, with 4 rated AA, 6 rated A, 11 rated BBB, 14 rated BB, 26 rated B, and 54 rated C. The proportion of enterprises rated as C reaches 47.55%. The average environmental score is 25.11, with a coefficient of variation of 0.63, greater than 0.3. There are significant differences in attitudes among industry enterprises towards environmental information disclosure, and no industry consensus has yet been formed. A few companies have shown outstanding performance in environmental information disclosure, while many adopt an avoidance attitude towards environmental information disclosure.

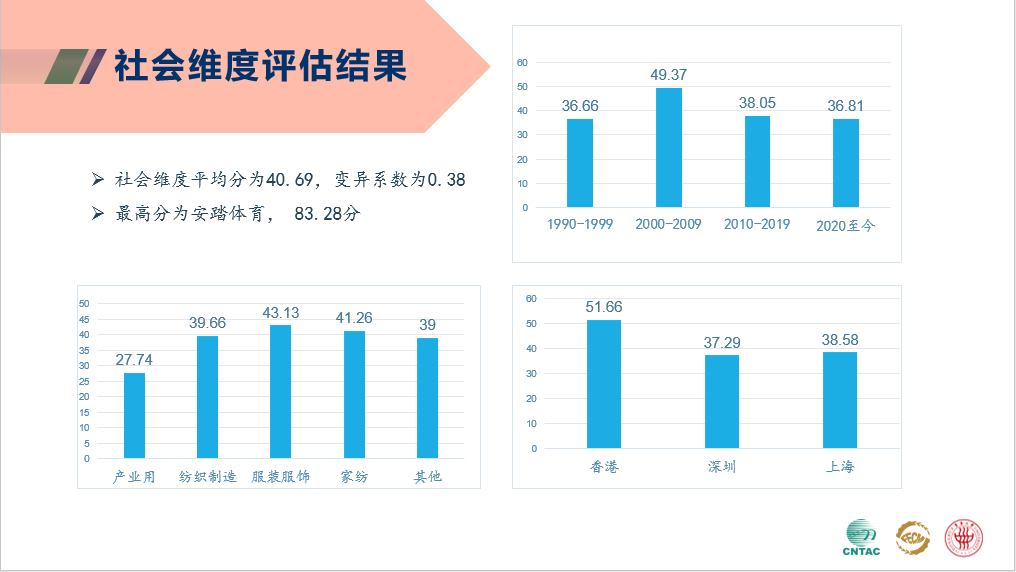

In social ratings, 5 companies have reached the AAA level, including 12 AA level companies, 11 A level companies, 22 BBB level companies, 38 BB level companies, 23 B level companies, and 5 C level companies. The number of companies rated BB level is the highest, accounting for 32.76%. The average social score is 40.69, with a coefficient of variation of 0.38, which is greater than 0.3, indicating significant differences in scores. Unlike environmental information disclosure, industry enterprises have made varying degrees of effort in social information disclosure, and few have adopted an avoidance attitude. However, the quality of information disclosure varies greatly, reflecting significant differences in understanding social issues among industry enterprises, and the overall ability to fulfill responsibilities needs to be improved.

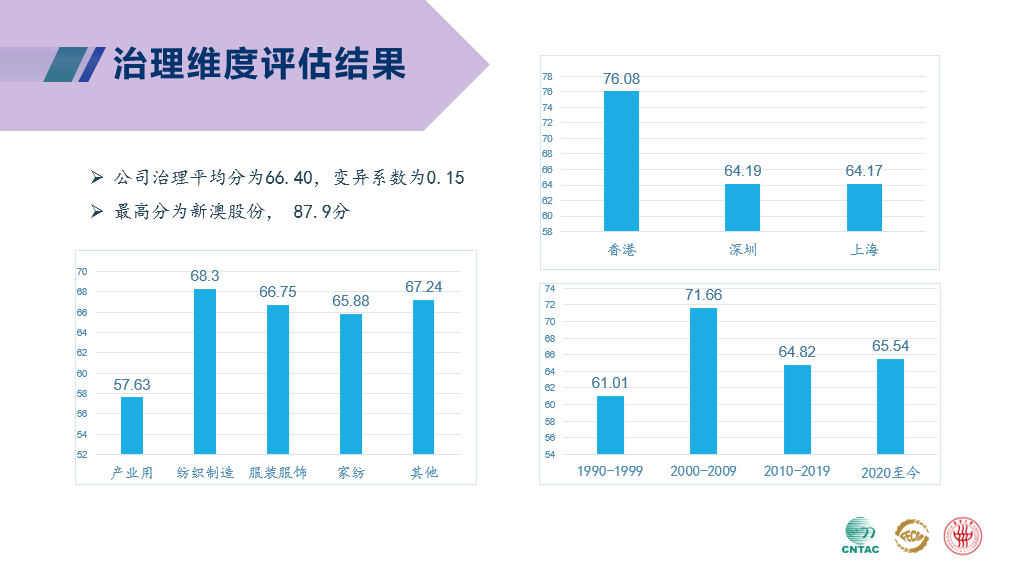

In the environmental rating system, 41 companies have reached the AAA level, 50 companies that have reached the AA level, 17 companies that have reached the A level, 8 companies that have reached the BBB level, and 0 companies that have reached the BB level, B level, and C level. The number of companies that have been rated the AA level is the highest, accounting for 43.10%. The average corporate governance score is 66.40, with a coefficient of variation of 0.15. The degree of data dispersion is relatively small, reflecting the efforts of industry enterprises in governance compliance.

Based on the ESG performance evaluation results of China’s textile and clothing industry from 2022 to 2023, the following suggestions are proposed:

In terms of improving environmental performance, it is recommended that enterprises strengthen the construction of environmental management systems. There is greater room for improvement in packaging material savings than water and energy. At the same time, considering the low willingness of enterprises to disclose environmental emission data, we call on them to participate together and explore solutions: how to protect industrial security while improving corporate transparency effectively. In addition, product design based on product lifecycle thinking needs to be strengthened.

Regarding improving social performance, working hours and social security remain important challenges in employee responsibility, and there are no significant risks to occupational health and safety. Enterprises generally emphasize after-sales feedback channels but avoid disclosing customer satisfaction levels. The differentiation of enterprise R&D investment is relatively obvious.

In terms of improving corporate governance performance, the diversity of senior management needs to be improved. Noncompliant incidents occur occasionally, and the construction of compliance systems needs to be strengthened. The level of ESG integration is generally poor, and only single-digit companies have clearly defined ESG incentive mechanisms for the board of directors/senior management. The responsible management level in the supply chain needs to be improved urgently.

To enhance the scientific and effective evaluation results, the Office for Social Responsibility of CNTAC will continue to track the ESG performance of listed companies in the industry and make corrections to their ESG evaluation results. Please log in to the ESG Public Service&CSC9000T Membership Platform of China's Textile and Clothing Industry for relevant achievements. |